Video Hosting in China: What You Need to Know in 2026

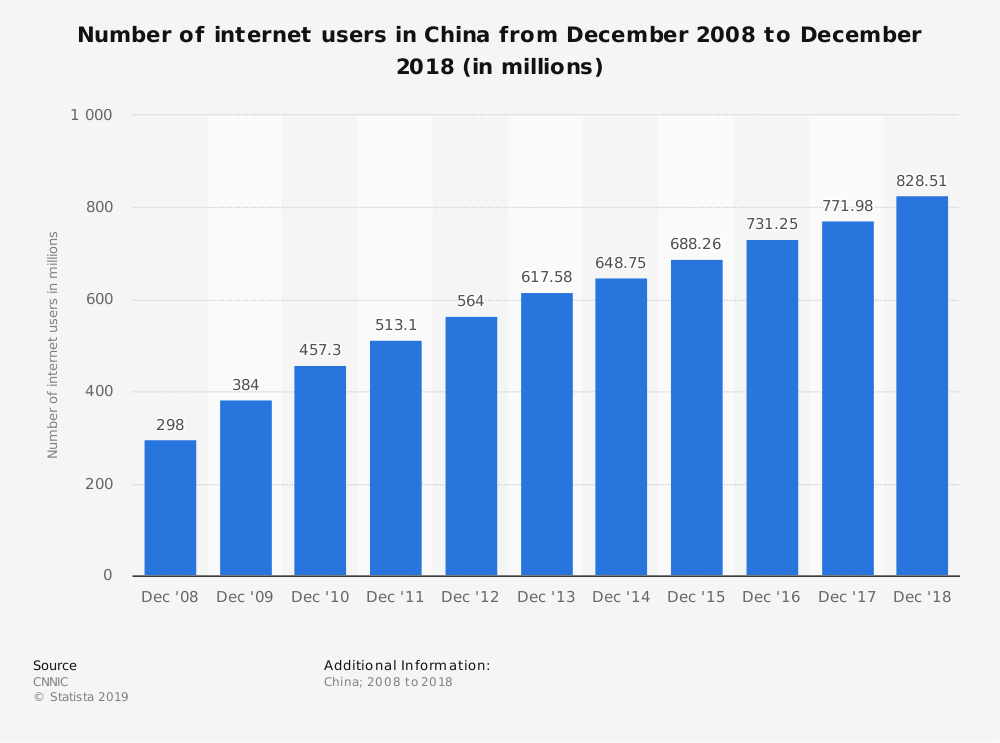

Over the past decade, China has become the world’s largest internet market—and video is the default way people learn, shop, and engage with brands.

By December 2024, China had 1.07 billion online video users, including 1.04 billion short-video users and 662 million micro-drama users.

By the end of 2025, China reached 1.125 billion internet users (80.1% penetration).

But for many international businesses, reaching viewers inside mainland China is still hard in 2026. The same content that streams perfectly in North America or Europe can buffer, fail to load, or get blocked entirely once it crosses the Great Firewall.

This guide explains what’s actually required for reliable, compliant video hosting in China in 2026 – what to do, what to avoid, and how to choose a delivery approach that won’t collapse on launch day.

This post is updated with the most accurate information available as of February 2026.

TL;DR: Video Hosting in China in 2026

If you want video to play reliably in mainland China, you need three things:

- A China-approved delivery path

- Your player + video delivery must use China-optimized routing and a China-licensed setup (often involving ICP备案/ICP许可证 and China CDN infrastructure).

- A “China-first” performance plan

- Local PoPs/edge caching, ISP-friendly routing, ABR playback, and realistic bitrate ladders.

- A compliance + data plan

- Content controls, moderation processes, and a clear stance on where Chinese-user data is stored/processed (PIPL and cross-border transfer rules matter).

Table of Contents

- What’s the Value of Video Hosting in China?

- What Do Chinese Audiences Want in 2026 ?

- The 3 Challenges to Chinese Video Hosting

- Bypassing the Great Firewall with an ICP License

- 3 Practical Delivery Options for Mainland China

- Technical Best Practices for China Playback (2026)

- Compliance Checklist: Content + Data + Operations

- External Video Hosting Sites Not Blocked in China

- Why Use Dacast for Video Hosting in China

- Emerging Trends in Chinese Video Hosting for 2026

- FAQs

- Conclusion

What’s the Value of Video Hosting in China?

China isn’t just “another market.” It’s a separate internet environment with its own platforms, hosting rules, and performance realities.

If you’re selling products, training partners, running events, or building a paid content library, China matters because:

- Scale: China has over 1.125B internet users.

- Video is mainstream: 1.07B people use online video; live streaming users reached 833M by December 2024.

- Commerce is video-native: China’s livestreaming e-commerce market reached ~$807B in 2024, and iResearch projected 18% CAGR (2024–2026).

Understanding the Chinese Audience

On top of that, the audience in China is relatively young, which projects well for future growth. For example, over half of online video viewers using these Chinese streaming platforms are in their teens and 20s.

That also explains the success of the Chinese tech giant Baidu for example. It ranked among the top Chinese streaming services and has been dubbed the “Netflix of China” due to its popularity among Chinese consumers.

Countless non-China businesses have good reason to invest in videos for Chinese audiences and break the monopoly of Chinese streaming platforms. In particular, there is a massive market for online video platforms, OTT, and entertainment. Ecommerce isn’t far behind as well. In fact, China is the biggest market in the world for ecommerce sites that want to tap into live streaming video shopping.

Best-fit use cases for “owned” video delivery in China

You’ll get the most value from reliable, private or controlled video hosting when you need:

- Enterprise training (employees, distributors, franchises)

- Paid education (courses, cohort programs, certifications)

- Product marketing (launches, demos, webinars)

- Live events (conferences, hybrid events, sports, brand activations)

- Internal communications (executive updates, compliance training)

What Do Chinese Audiences Want in 2026 ?

Chinese viewers are mobile-first and performance-sensitive. If video doesn’t start quickly, they bounce.

Key consumption patterns in 2026:

- Short video + micro-dramas dominate: 1.04B short-video users and 662M micro-drama users (Dec 2024).

- Live is normal: 833M live-streaming users (Dec 2024).

- “Watch-and-buy” behavior is mature: livestream commerce is a core buying channel.

- Localization is expected: Mandarin-first UX, culturally appropriate creative, and platform-native distribution (WeChat ecosystems matter).

Practical guidance:

If your content is long-form (webinars, courses, training), invest in fast startup + stable ABR. If it’s marketing, plan for short clips + live moments you can distribute natively on Chinese platforms (in parallel to your owned player).

The 3 Challenges to Video Hosting in China

Foreign companies face several challenges when streaming live video into China. The greatest challenge is the Great Firewall, the sole purpose of which is blocking free access to certain foreign websites in China. The Chinese government’s censorship system controls it, which makes it difficult for people in China to stream unapproved content through any video hosting service.

It also slows down Internet speeds, so broadcasters must fight against slow speeds and high bandwidth costs when streaming to China.

Let’s look at three such challenges in a bit more detail.

1. Great Firewall and platform Blocks

China’s filtering and traffic inspection can block or degrade foreign services, especially when your video delivery depends on domains, scripts, APIs, or CDNs that aren’t consistently reachable from within the mainland.

“Not blocked” is not the same as “works well.” Many stacks load inconsistently, even when the homepage is reachable.

2. Speed, Latency, and Routing

Many broadcasters find that even when content delivery networks (CDNs) stream video to China from outside the mainland, the speed and quality could be better and more consistent. This is mostly due to the restraints posed by the Great Firewall. One of its purposes is to inspect and filter traffic, which adds a delay and can disrupt the data flow.

This is a challenge that faces all external streaming platforms ranging from the largest online video platforms to live streaming platforms and even short video platforms.

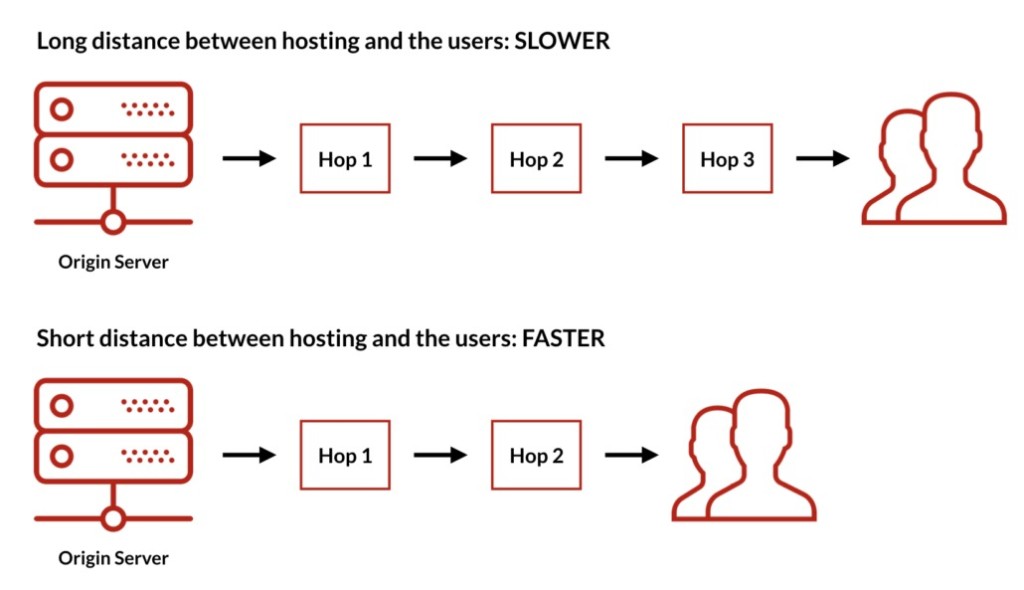

CDNs reduce loading and buffering by caching content at the server closest to the viewer. That ensures that all video streaming is done from a server near viewers anywhere in the world. The server used to provide the content depends on what type of “points of presence” (POPs) are near the viewer.

For a Chinese viewer, content is often streamed from as far away as Seattle, which leads to significant speed and latency problems. In addition, the longer a video travels to reach the viewer, the more the speed and viewing quality are impacted.

The further you are from the server, the more intermediary points the request and the response have to go through to reach the viewer. So, no matter how fast your ISP advertises your connection speed, these issues still need to be solved.

If it takes a second or more to make a request and receive a response, the likelihood is that your viewers don’t have a great experience.

To provide an excellent viewing experience, you must cut the distance between where you’re hosting the video and where your viewers are. For example, fast and consistent content delivery to China means using a hosting service in the country, not thousands of miles away.

That’s why choosing a live-streaming service or CDN with its servers within China is critical. It minimizes the distance between the CDN and the viewers and reduces the lag.

3. Licensing, Compliance, and Data Rules

China’s licensing environment is strict, and data requirements are tightening.

- Hosting content on mainland servers typically requires ICP备案 (and sometimes additional permits depending on your business model).

- Cross-border data transfers have specific compliance paths; a CAC filing for a standard contract became effective in 2024, and regulators have continued evolving requirements.

Bypassing the Great Firewall with an ICP License

Let’s be clear: you don’t “hack around” the Great Firewall in a way that’s reliable for business. The practical way to reach mainland viewers is to use a China-licensed delivery setup.

What is an ICP license (and ICP filing)?

ICP stands for Internet Content Provider. In practice, there are two common buckets you’ll hear:

- ICP Filing (备案): baseline registration commonly required for websites hosted on mainland China infrastructure.

- Commercial ICP / value-added telecom licensing: needed for certain commercial online services, requirements depend on what you’re operating.

Important: foreign entities often cannot directly complete certain licensing steps without a local structure/partner, so most international businesses either:

- partner with a China-licensed provider, or

- set up a local entity + local hosting + local compliance.

ICP “gotchas” that break launches

- Your ICP number must be displayed on the site/app experience where required (often in the footer).

- Changing domains, hosting regions, or certain service components can require updates or re-filings.

- Your requirements may expand if you move into UGC, public content distribution, or certain media categories (licensing can get deeper for audio-visual services).

3 Practical Delivery Options for Mainland China

Here’s the decision framework most teams wish they had earlier.

A. Use a platform that already supports China delivery (fastest)

Best for: businesses that want predictable playback without building a local stack.

What you get:

- A China-ready delivery pathway (provider handles the heavy lifting)

- Faster time-to-launch

- Fewer moving parts to maintain

What to confirm before you sign:

- Proof of ICP备案/registration and what it covers (domain, player, delivery endpoints)

- China PoPs and ISP connectivity (China Mobile / Unicom / Telecom behavior matters)

- China-specific SLA/expectations (startup time, buffering, failover)

Example: Dacast lists an ICP registration number (京ICP备19031887号) on its site.

B. Hybrid: keep your global OVP, add a China delivery layer

Best for: teams with an existing global video workflow who only need China reach for specific audiences.

You’ll typically:

- mirror or replicate assets into a China-capable delivery environment

- route China viewers to a China-optimized player/CDN path

- keep global viewers on your existing CDN

This works well, but only if you implement clean georouting and consistent DRM/auth logic.

C. Go fully local (maximum control, maximum complexity)

Best for: companies with large China revenue, local teams, and long-term investment.

You’ll need:

- local cloud/hosting + local CDN

- ICP备案 (and potentially more licensing depending on content and distribution)

- local compliance + moderation operations

- local analytics/monitoring stack

Technical Best Practices for China Playback (2026)

Use this as your “minimum viable reliability” checklist.

1. Always ship ABR (adaptive bitrate)

ABR is non-negotiable in China because network quality varies by region, ISP, and time of day.

Recommended ABR ladder (starting point):

- 360p (≈600–900 Kbps)

- 540p (≈1.2–1.8 Mbps)

- 720p (≈2.5–4.5 Mbps)

- 1080p (≈4.5–6.5 Mbps)

2. Prioritize universal codecs unless you’ve tested otherwise

H.264 + AAC remains the safest baseline for broad device compatibility (especially enterprise environments). (Example: Dacast recommends MP4 / H.264 / AAC as an optimal default.)

3. Reduce startup time before chasing ultra-high resolution

In China, “fast start + stable playback” usually beats “4K marketing.”

Practical wins:

- shorter GOP / keyframes tuned for streaming

- smaller initial chunk sizes (platform-dependent)

- aggressive edge caching inside China

4. Design for live + clips, not live or VOD

If you do live events, plan the whole loop:

live → automatic recording → highlights → short clips for distribution

China audiences engage heavily with clipped content and short-form replays.

5. Plan around 5G-Advanced expansion (but don’t assume perfect mobile)

China has rolled out 5G-Advanced (5G-A) in 300+ cities, and 5G infrastructure keeps scaling.

That helps live streaming, but regional variability still exists, so ABR and local PoPs remain essential.

Compliance Checklist: Content + Data + Operations

Content compliance

- Create a content review workflow (pre-publish checks for sensitive topics)

- Keep moderation response times defined (who can pull content quickly?)

- Maintain a local escalation path (legal/compliance contacts)

If your model includes UGC, public distribution, or certain media categories, your licensing obligations can expand beyond ICP basics.

Data compliance (plan it early)

- Minimize the personal data you collect from China viewers

- Know where authentication, analytics, and logs are stored

- If data leaves China, ensure you have an appropriate compliance mechanism (rules continue evolving).

Operational compliance

- Document what happens if a stream is flagged or degraded

- Build a “China incident runbook” (ISP routing, CDN failover, support escalation)

- Schedule periodic audits of domains/endpoints used by your player

External Video Hosting Sites Not Blocked in China

If you’re not ready to build a legal/technical footprint in mainland China yourself, the most practical approach is to use a provider that already offers a China-capable delivery path (typically via an approved onshore setup and a China-optimized CDN). Just keep in mind:

- “Not blocked” does not automatically mean “reliable at scale.”

- China delivery can fail because of player scripts, APIs, analytics beacons, auth flows, or CDN endpoints—not just the video files.

- Capabilities and partnerships change. Always ask for proof (ICP details, China PoPs, test plan) and run a mainland playback test before launch.

3 real-world options for reaching viewers in mainland China

Option A : Use an OVP with a China delivery solution (fastest path)

Best for: companies that want predictable playback without building infrastructure.

Examples of platforms that publicly document China delivery options or ICP-related guidance include:

- Dacast (lists ICP registration/number and promotes China delivery)

- Brightcove (offers an official “China Delivery” option; notes it can’t act as an intermediary for ICP licensing)

Option B : Deploy an enterprise platform onshore (more control, more work)

Best for: large orgs with compliance needs, local IT support, or private/internal video.

Typical stack: onshore cloud + China CDN + your own ICP filing/licensing workflow.

(For example, platforms like Panopto support on-prem deployment; China performance varies and usually requires a China-specific approach.)

Option C : Distribute via Chinese platforms (fast reach, less control)

Best for: marketing and public content where platform distribution is acceptable.

Downside: less control over branding, data, monetization, and long-term access.

| What you need | Best fit | What to confirm before you commit |

|---|---|---|

| “Just make it play reliably in mainland China” | Option A (China-capable OVP) | China delivery architecture, ICP coverage/responsibility, China PoPs/CDN partner, mainland test plan |

| Private training / internal comms / controlled access | Option B (Onshore deployment) | ICP filing requirements, onshore hosting scope, data residency, operations + moderation processes |

| Fast awareness + social growth | Option C (Chinese platforms) | Platform policy fit, content review needs, account verification, monetization rules |

Why Use Dacast for Video Hosting in China

When it comes to finding a reliable VOD video hosting platform in China, Dacast is one of the best choices. It’s on the list of very few online streaming platforms that support private video hosting in China. That alone makes it one of the best Chinese streaming services you can work with.

We have already been through the complicated process of gaining approval to deliver content in China, and we have an ICP license from the Chinese government. We’ve also set up local PoPs and have propagated their connectivity.

It’s important to note that not all “global” video streaming CDNs are registered and can deliver content in mainland China. Truly global CDN providers, like Dacast, can deliver content beyond the Great Firewall and anywhere in the world.

The good news? Dacast customers can deliver the same high-quality viewing experience to their Chinese viewers as they do to their audiences in other parts of the world. In addition, Dacast can provide you with the ability to offer both videos-on-demand and live-streamed content to China.

With access to over 60,000 servers across China, we can deliver high-quality video content even to those located away from the populous Eastern seaboard.

Dacast can support both on-demand and live-streaming content in China, so we have you covered no matter how you want to connect with your Chinese audience. As you can see, Dacast clearly stands above other providers, especially for business use. Some of the features that make Dacast stand out include:

- Existing ICP License: Dacast already has an ICP license for video hosting and streaming in China, simplifying the bureaucratic process of acquiring permission.

- Established Infrastructure: Dacast guarantees minimal latency and reliable delivery thanks to over 60,000 servers and multiple POPs in China.

- Advanced Features: It has tools like AES encryption, DRM, and a bulk uploader, making it ideal for businesses with high security or content management needs.

- Customer Support: It provides users with 24/7 multilingual support for troubleshooting and guidance.

- Cost Efficiency: It offers much more competitive pricing for bandwidth and hosting services compared to IBM Cloud Video or Panopto.

Emerging Trends in Chinese Video Hosting for 2026

1. Micro-dramas + short series are now “mainstream video”

Micro-drama adoption is already massive (662M users by Dec 2024).

If you publish education or marketing content, consider serializing it into short episodes.

2. Livestream commerce keeps shaping video UX

Livestream e-commerce hit ~$807B in 2024 and is projected for strong growth through 2026.

Even if you’re not an e-commerce brand, audiences expect:

- real-time interaction

- clear CTAs

- fast, mobile-friendly playback

3. 5G-Advanced expansion improves live reliability

5G-A rollout is accelerating, but routing and ISP behavior still make local PoPs and ABR essential.

4. AI is becoming a default layer in the video workflow

China reported large-scale AI adoption momentum, and AI features increasingly show up in translation, dubbing, captions, moderation, highlights, and personalization.

FAQs

1. What streaming platforms are used in China?

Major categories include long-form platforms (Tencent Video, iQiyi, Youku), short video (Douyin, Kuaishou), and community video (Bilibili). Many brands also distribute via WeChat ecosystems.

2. Which video hosting website is based in China?

There are several video hosting websites based in China that you can use to reach the country’s audience. Some of those platforms include Dacast, Tencent Video (sometimes known as QQ Video), Youku, IBM Cloud Video, and more. iQiyi is another popular video-hosting website in China, often compared to Netflix.

3. What is the most popular video site in China?

Currently, the most widely used video site in China is Tencent Video. It has 435 million monthly active users and around 117 million users that pay to use the service. Part of its success is because it’s closely related to WeChat, a type of social media platform in China.

4. What do Chinese use instead of YouTube?

Sites that primarily host user-generated content, like YouTube and Vimeo, are banned in China. Instead, Chinese audiences use Youku, which many consider the Chinese YouTube equivalent. It has a user base of over 500 million monthly active users, and the videos on the site generate over 800 million daily views. This service is owned by Alibaba and offers a great place to share your video content with your target audience in China.

5. What’s the easiest way to share video with someone in China?

Use a delivery method that’s designed for mainland playback (China-licensed OVP/CDN path), or publish natively on Chinese platforms if public distribution is acceptable.

6. Can I use YouTube, Facebook, or Vimeo in China?

These platforms are often inaccessible or unreliable from mainland China. For business-critical playback, use a China-capable delivery path.

Conclusion

Video hosting in China can be incredibly beneficial for your business and revenue, especially if you’re trying to reach viewers within the Great Firewall. With the potential problems with non-China hosting, it’s good to know there are viable ways of streaming and broadcasting your video content in mainland China.

As one of the rare platforms that provides video hosting in China, Dacast offers advanced features for publishers or businesses focused on video hosting more than live streaming. These features include AES encryption, an advanced bulk uploader with Dropbox integration, and a super-easy video management system.

Try these features risk-free in our 14-day free trial. All you have to do is sign up today to get started. Just click the link below to get free streaming for a full two weeks (no credit card required).

Finally, if you have further questions or thoughts, feel free to leave us a comment below. Are you looking for more live streaming tips, industry networking opportunities, and exclusive offers? If so, you can also join our LinkedIn group.

Thanks for reading, and happy broadcasting!

Stream

Stream Connect

Connect Manage

Manage Measure

Measure Events

Events Business

Business Organizations

Organizations Entertainment and Media

Entertainment and Media API

API Tools

Tools Learning Center

Learning Center Support

Support Support Articles

Support Articles